This test is on the S&P 500 stocks.

The rules are buy at the next market open on a limit order if the 2 period rsi is below 2 and the stock is above the 200 day moving average.

All trades are taken in the test and no stops are used.

Exit when the stock closes above the 9 day moving average.

This test is for long only.

No transaction costs are figured.

The strategy buys 100 shares per trade. However to make this worth it, you would need to trade a minimum of 200 shares. (The average profit per trade is only $27 on 100 shares.

A couple of things to point out.

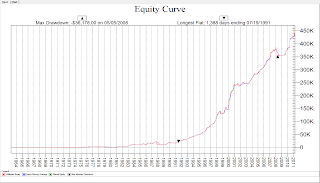

The average profit per trade is low so it requires a decent position size.The draw downs were very small and it has a nice 45 degree angle equity curve.

You probably can't take every trade on big pullbacks when there are many opportunities to pick.

No stops are used in this test but I will likely create another similar test with a stop and see how much of an effect it has.

The stop will have to be a rather wide stop as more of a catastrophic protection. Only protective puts protect from overnight exposure and those could be used in conjunction with the strategy.

I buy the S&P stocks when they hit 5 on the 2 period rsi, but I plan for a maximum of 4 buy ins as the stock drops. This above method figures only 1 buy in at a lower 2 period rsi level.